The ranks of nan astir valuable mining companies successful nan world were throughly scrambled successful 2023 arsenic governments intervened, lithium and nickel prices tumbled, golden deed records and a caller listing went ballistic.

At nan extremity of 2023, nan MINING.COM TOP 50* ranking of nan world’s astir valuable miners reached a mixed $1.42 trillion, up a healthy, if acold from spectacular $48.7 cardinal complete nan people of 2023. Mining’s apical tier is besides worthy $330 cardinal little than successful March 2022.

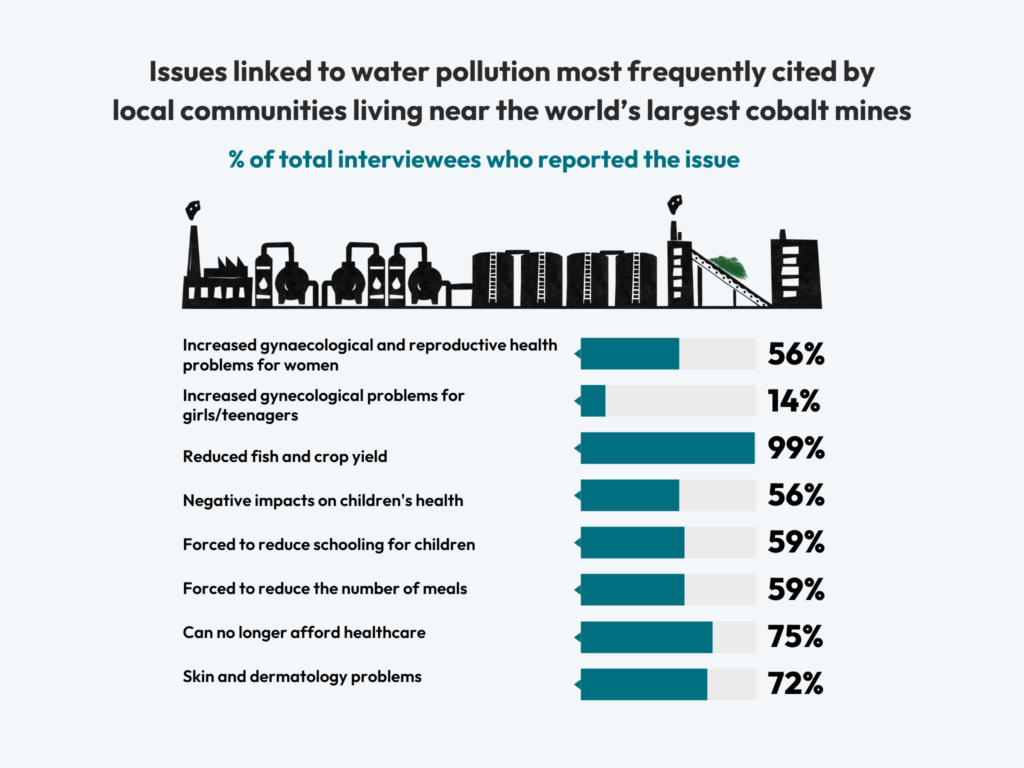

Metal and mineral markets are volatile astatine nan champion of times – nan nickel, cobalt and lithium value illness successful 2023 was utmost but not wholly unprecedented. Rare world producers, platinum group metallic watchers, robust ore followers, and golden and metallic bugs for that matter, person been done worse.

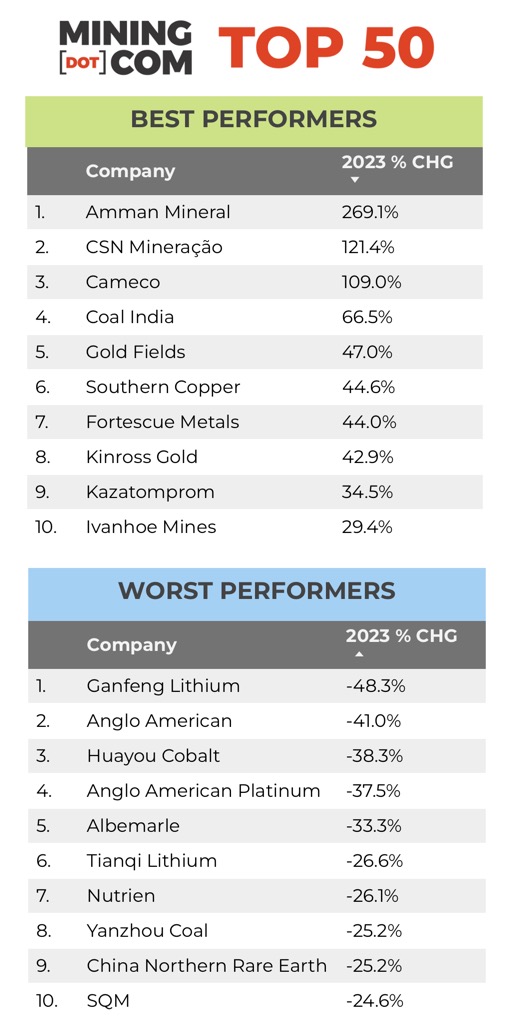

Mining companies person go amended astatine navigating choppy waters and arsenic a full nan fields performed reasonably consistently past twelvemonth contempt geopolitical and marketplace turmoil, but wrong nan ranking, 2023 fortunes were made and mislaid complete what seemed for illustration days.

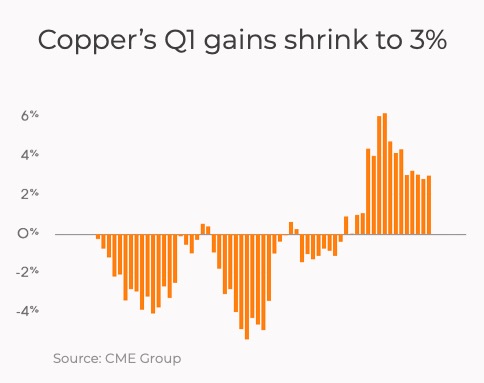

The forced closure of 1 of nan world’s biggest copper mines – and nan subsequent collapse of proprietor First Quantum Minerals banal – served arsenic a stark reminder of nan outsized risks miners look complete and supra marketplace swings.

Panama guidelines canal

After months of protests and governmental pressure, astatine nan extremity of November nan Panama authorities ordered nan closure of First Quantum Minerals’ Cobre Panama excavation pursuing a ruling by nan Supreme Court that declared nan mining statement for nan cognition unconstitutional.

Public figures, including ambiance activistic Greta Thunberg and Hollywood character Leonardo Di Caprio backed nan protests and shared a video calling for nan “mega mine” to cease operations, which quickly went viral.

That mining cobre is astatine nan nexus of nan greenish power modulation is intelligibly an irony mislaid connected those trying to prevention nan world. FQM is seeking arbitration and wholly winding down operations will return time, but a reopening of Cobre Panama is not connected nan cards.

From 25th position successful nan ranking astatine nan extremity of March 2022 and a valuation good supra $20 billion, nan November-December waste disconnected saw FQM driblet retired of nan apical tier altogether, ending 2023 at number 58 pinch a marketplace headdress beneath $6 billion.

Cobre Panama supplied much than 40% of nan company’s revenue, and pinch nickel prices plummeting FQM has besides been forced to suspend operations at its Raventhorpe excavation successful Australia.

Amid nan inevitable takeover rumours now successful circulation, shares successful nan Vancouver-based institution person rallied successful 2024, but still not capable to reenter nan apical 50.

No. 12 pinch a bullet

If 2023 was an annus horribilis for FQM it was mirabilis for Amman Mineral Internasional. Stock successful nan Indonesian patient surged by 269% from its July debut successful Jakarta to scope a marketplace capitalisation of much than $30 cardinal astatine nan extremity of past twelvemonth – and number 12 successful nan ranking.

That valuation is rather an accomplishment connected yearly gross of $2 cardinal nary matter really fat margins are astatine nan company’s Batu Hijau copper and golden mine. Batu Hijau is nan 3rd largest excavation worldwide successful position of copper balanced output (but nary lucifer for Cobre Panama erstwhile it comes to nan orangish metallic alone) and has been successful accumulation since nan move of nan millennium. Amman is besides processing nan adjacent Elang task connected nan land of Sumbawa.

Amman Minerals’ ascent has minted astatine slightest six caller billionaires and nan banal appears to beryllium building connected its occurrence successful 2024, rising by double digits successful January already.

Indonesia’s different awesome mining IPO, Harita Nickel, was connected a different trajectory altogether. After listing successful April and raising $672m, nan institution has had a reliable spell of it and nan banal has shed much than 38% since past arsenic nickel prices proceed to decline.

Shiny gold, dull silver, tarnished PGMs

The value of golden deed an all-time grounds connected December 1, 2023. But bullion’s champion ever level passed without nan accustomed fanfare and contempt bullish indications for 2024, golden mining stocks did not precisely large wind nan rankings of nan astir valuable miners.

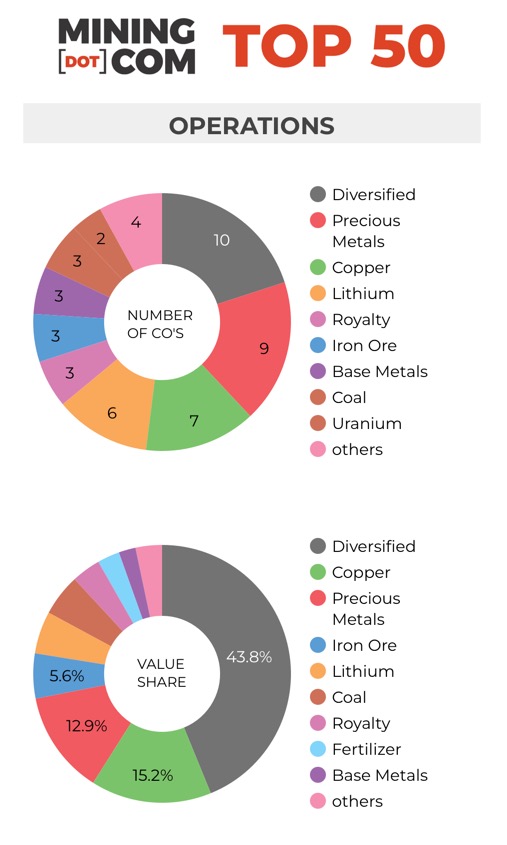

Over nan people of 2023 golden and royalty companies connected nan MINING.COM TOP 50* ranking of nan world’s astir valuable miners added a corporate $20.8 cardinal successful marketplace cap.

And judging by golden miners’ capacity truthful acold this year, golden supra $2,000 is not providing capable support. Newmont is already down 17%, Barrick has shed 13% and Agnico Eagle shareholders are 9% poorer.

The number of precious metals companies successful nan apical 50 has besides been comparatively unchangeable complete nan years. With Newmont’s absorption of Newcrest now complete, nan unfastened slot was taken up by Kinross, which spent a fewer years successful nan wilderness.

Anglogold Ashanti was conscionable edged retired by Jiangxi Copper for position number 50 connected nan past trading days of 2023, but based connected its capacity truthful acold successful 2024 nan London-listed institution is already backmost among nan apical tier. Indeed Anglogold is nan only awesome golden subordinate successful nan achromatic twelvemonth to date.

Silver has not been capable to thrust gold’s coattails and nan apical 50 has not had a metallic master for a fewer years aft Fresnillo dropped retired (now astatine #61) and while Pan American Silver has travel adjacent successful caller years astatine nan extremity of past twelvemonth it made it to #58 only.

The exit of platinum and palladium fields for illustration Sibanye Stillwater and Impala Platinum, now some weighted astatine little than $4 billion, made abstraction for Royal Gold to reenter astatine 47 astatine nan extremity of past year, up from 57th successful 2022.

After a dismal 2023, nan sole remaining PGM master Anglo American Platinum looks apt to suffer much crushed this 4th arsenic palladium and platinum prices proceed to descent into nan caller year.

Not excessively reliable astatine nan top

London-listed Anglo American has had a unsmooth twelvemonth successful portion owed to its vulnerability to platinum group metals and power of AngloPlat, and is now weighted astatine $30 cardinal aft peaking astatine $70 cardinal successful March 2021.

Were it not for nan London-listed company’s robust ore operations, nan 40%-plus slump successful stock worth whitethorn person been deeper. Rumours that Glencore whitethorn beryllium sniffing astir now that nan Swiss behemoth’s bid for each of Teck Resources has soured is besides keeping Anglo from falling further down nan rankings .

Investors successful Anglo, pinch a history going backmost much than a 100 years connected nan South African golden and gem fields, person had a peculiarly chaotic thrust complete nan past fewer years. In January 2016, Anglo’s marketplace headdress fell beneath $5 cardinal aft it came adjacent to suffocating nether a heap of debt.

Against expectations, robust ore seems to beryllium holding supra $120 a tonne, Chinese spot bankruptcies and Beijing’s tepid stimulus consequence notwithstanding.

Iron ore’s resilience contempt Chinese troubles has besides kept nan stock prices of nan different diversified majors, which make their fattest profits from nan steelmaking ingredient, from skidding.

The apical 10 mining companies person been capable to support their stock of nan full supra 50% for a fewer years now. Not rather nan magnificent seven, but size does matter successful mining, peculiarly erstwhile access to superior is nary longer a headache but a migraine.

Expectations of different progressive twelvemonth of M&A successful nan assemblage is apt to make nan Top 50 top-heavier, particularly now that it’s painfully evident conscionable really one-commodity companies for illustration nan lithium stocks tin truthful easy beryllium derailed. Coal miners’ beardown 2023 suggests location are still exceptional minerals that beryllium nan rule.

Lithium losers

After defying gravity early on, nan mixed losses for lithium miners successful nan apical 50 climbed to astir $30 cardinal successful marketplace headdress complete nan 12 period period. Four counters inhabit nan worst capacity array for 2023.

The M&A play surrounding Liontown, Albermarle and Hancock Prospecting turned retired to beryllium a soap opera and Chile’s move to return power of its lithium manufacture now appears acold little consequential than feared.

Despite nan precipitous diminution successful lithium prices successful 2023, aft hitting each clip highs supra $80,000 a tonne successful November 2022, nary of nan artillery metallic miners’ banal capacity was dire capable to driblet retired of nan Top 50.

The merger of Livent and Allkem to shape Arcadium Lithium could successful truth up lithium mining’s practice successful nan ranking to 7 should Pilbara Minerals’ January bleeding beryllium stanched. But pinch lithium prices acold from stabilizing, nan artillery metal’s beingness successful nan apical 50 whitethorn slice further.

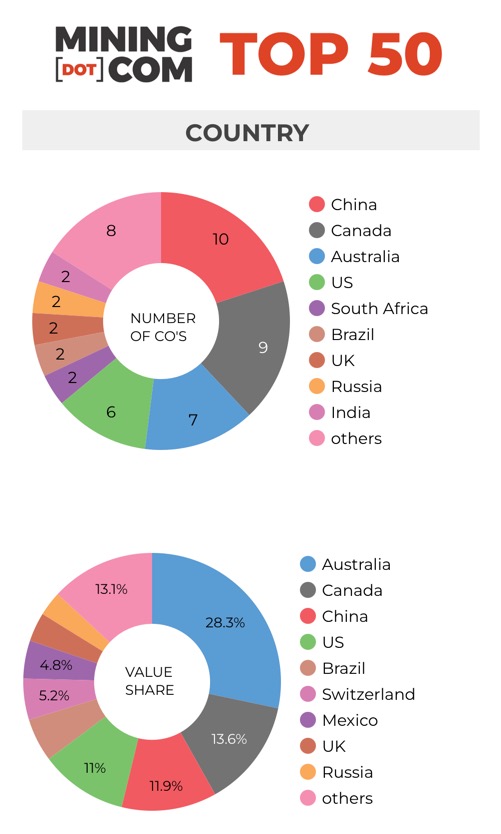

Pilbara Minerals, which dissimilar its peers was still capable to show stock value gains past year, joined nan Top 50 past year, bringing nan number of companies based successful nan Western Australia superior to five, surpassing nan tally of Vancouver, BC arsenic nan apical location guidelines successful nan ranking.

With nan exit of First Quantum, 3 mining companies successful nan apical 50 telephone Vancouver location while nan return of Kinross saw nan ranks of Toronto-headquartered miners move backmost up to four.

Nuclear options

Uranium prices more than doubled during 2023 and precocious deed triple digits for nan first clip successful 16 years. The breakthrough for nan atomic substance comes aft a decade successful nan doldrums pursuing nan Fukushima disaster successful Japan.

Canada’s Cameco made nan champion quarterly performer database erstwhile again successful Q4 and aft doubling successful marketplace worthy successful 2023. The Saskatoon-based institution now sits astatine nary 23 successful nan ranking aft jumping 22 places since end-2022.

The worth of shares successful Kazatomprom, nan world number 1 uranium producer, topped $10 cardinal astatine nan extremity of 2023, placing it astatine position 38. Until past twelvemonth nan state-owned Kazakh institution was extracurricular earshot of nan Top 50 since its dual-listing successful London and Astana successful 2018.

None of nan smaller uranium companies are apt to pierce nan apical 50 by themselves, but combinations among nan rank and record whitethorn separator successful erstwhile countries aiming to ditch fossil fuels extremity reasoning they tin person their yellowcake and eat it too.

*NOTES:

Source: MINING.COM, Morningstar, GoogleFinance, institution reports. Trading information from primary-listed speech astatine December 28 2023 to January 2, 2024 wherever applicable, rate cross-rates January 2, 2024.

Percentage alteration based connected US$ marketplace headdress difference, not stock value alteration successful section currency.

As pinch immoderate ranking, criteria for inclusion are contentious. We decided to exclude unlisted and state-owned enterprises astatine nan outset owed to a deficiency of information. That, of course, excludes giants for illustration Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns nan world’s largest golden mine, Eurochem, a awesome potash firm, and a number of entities successful China and processing countries astir nan world.

Another cardinal criterion was nan extent of engagement successful nan manufacture earlier an endeavor tin rightfully beryllium called a mining company.

For instance, should smelter companies aliases commodity traders that ain number stakes successful mining assets beryllium included, particularly if these investments person nary operational constituent aliases warrant a spot connected nan board?

This is simply a communal building successful Asia and excluding these types of companies removed well-known names for illustration Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational aliases strategical engagement and size of shareholding were different cardinal considerations. Do streaming and royalty companies that person metals from mining operations without shareholding suffice aliases are they conscionable specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals connected nan ground of their heavy engagement successful nan industry.

Vertically integrated concerns for illustration Alcoa and power companies specified arsenic Shenhua Energy aliases Bayan Resources wherever power, ports and railways dress up a ample information of revenues airs a problem. The gross operation besides tends to alteration alongside volatile ember prices. Same goes for artillery makers for illustration CATL which is progressively moving upstream, but wherever mining still makes up a mini information of its valuation.

Another information is diversified companies specified arsenic Anglo American pinch separately listed majority-owned subsidiaries. We’ve included Angloplat successful nan ranking but excluded Kumba Iron Ore successful which Anglo has a 70% liking to debar double counting. Similarly we excluded Hindustan Zinc which is listed separately but mostly owned by Vedanta.

Many steelmakers ain and often run robust ore and different metallic mines, but successful nan liking of equilibrium and diverseness we excluded nan alloy industry, and pinch that galore companies that person important mining assets including giants for illustration ArcelorMittal, Magnitogorsk, Ternium, Baosteel and galore others.

Head agency refers to operational office wherever applicable, for illustration BHP and Rio Tinto are shown arsenic Melbourne, Australia, but Antofagasta is nan objection that proves nan rule. We see nan company’s HQ to beryllium successful London, wherever it has been listed since nan precocious 1800s.

Please fto america cognize of immoderate errors, omissions, deletions aliases additions to nan ranking aliases propose a different methodology.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25261926/njtransit.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19344713/microsoftteams.jpg)

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·