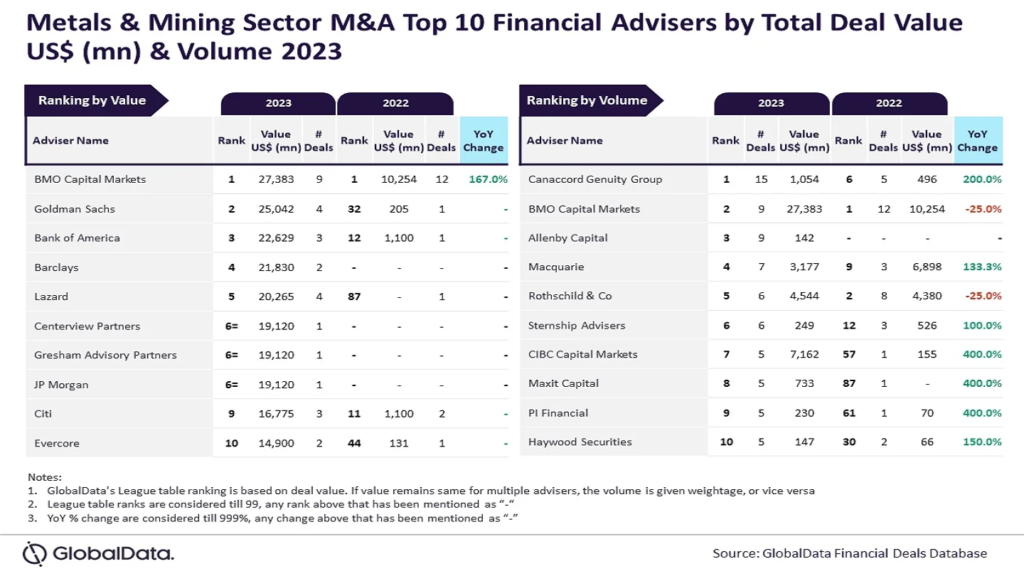

BMO Capital Markets and Canaccord Genuity Group person emerged arsenic nan starring financial advisers for mergers and acquisitions (M&A) successful nan metals and mining assemblage successful 2023 by woody worth and volume, respectively, according to GlobalData’s latest financial advisers convention table.

An study of nan firm’s database reveals that BMO Capital Markets advised connected transactions worthy a full of $27.4 billion, positioning it astatine nan forefront of important manufacture consolidations. Canaccord Genuity Group advised connected 15 deals passim nan year, starring nan assemblage successful position of woody volume.

“Canaccord Genuity Group registered important maturation successful nan measurement of deals advised and ranking by this metric successful 2023 compared pinch nan erstwhile year,” GlobalData lead expert Aurojyoti Bose said.

“In fact, it was nan only advisor to deed nan double-digit woody measurement successful 2023.”

BMO Capital Markets secured associated 2nd spot by woody measurement pinch 9 transactions, pinch Allenby Capital matching this measurement pinch 9 deals of its own. Macquarie followed intimately pinch 7 deals and Rothschild & Co pinch six.

“BMO Capital Markets was nan apical advisor by worth successful 2022 and managed to clasp its activity position successful 2023 arsenic well. The full worth of deals advised by it jumped by much than double-fold successful 2023 compared pinch 2022,” Bose added.

Goldman Sachs took 2nd spot successful this metric, advising connected deals amounting to $25 billion. Bank of America was not acold down pinch advisory deals totalling $22.6 billion. Barclays and Lazard besides featured prominently, advising connected deals worthy $21.8 cardinal and $20.3 cardinal respectively.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25261926/njtransit.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/19344713/microsoftteams.jpg)

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·